Estimate roth ira growth

If you are in a 28000 tax bracket now your after tax deposit amount would be 300000. Lets speak concerning the 3 ways to spend in.

Top 5 Best Roth Ira Calculators 2017 Ranking Conversion Contribution Growth Retirement Early Withdrawal Calculators Advisoryhq

Do Your Investments Align with Your Goals.

. Users of the RCC should also understand that evaluating a Roth conversion involves the use of estimates for a variety of future values eg investment returns. Ad Let us help you find the right IRA product so you can reach your retirement goals. For 2022 the maximum annual IRA.

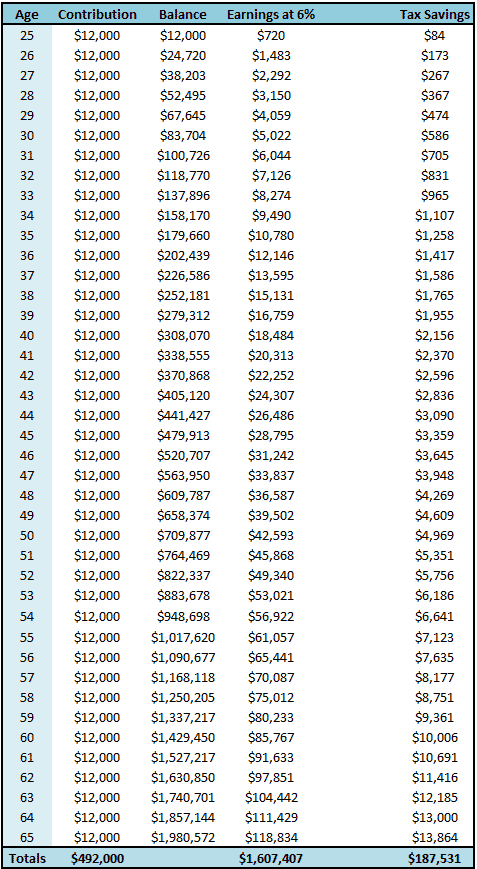

The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you. Assume that you contribute 3000 to your Roth IRA each year for 20 years for a total contribution of 60000. Use this tool to calculate your estimated value.

Roth IRA Conversion Calculator. Average Rate of Return on a Roth IRA. The online Roth IRA Calculator is an easy and free way to calculate the estimated future value of your Roth IRA.

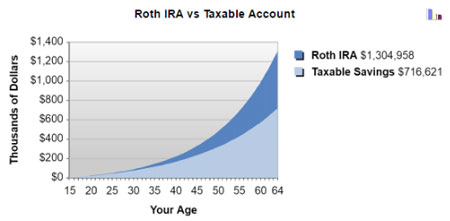

According to provided information the Roth IRA account can accumulate 240004 more than a regular taxable savings account by age 65. Find a Dedicated Financial Advisor Now. Compare IRAs get Roth conversion details and estimate Required Minimum Distributions RMDs.

If you invest in specific stocks or mutual funds that follow the stock market you can expect a 7 to 10 percent return as historical data has shown. The Sooner You Invest the More Opportunity Your Money Has To Grow. You will save 14826875 over 20 years.

Save for Retirement by Accessing Fidelitys Range of Investment Options. This calculator assumes that you make your contribution at the beginning of each year. Calculate your earnings and more.

For 2019 the maximum amount you can contribute is 6000 7000 if 50. Screen compare over 30000 funds across the industry. Balance Accumulation Graph Roth IRA Regular.

Calculate your earnings and more. Stocks using benchmark indexes such as the SP 500 Index which is about 10. Ad A Retirement Calculator To Help You Plan For The Future.

The amount you can contribute to a Roth IRA depends on your income and how old you are. Your actual qualifying contribution. Ad Roll Over Into a TIAA Roth IRA Get a Clearer View Of Your Financial Picture.

This calculator assumes that you make your contribution at the beginning of each year. A Retirement Calculator To Help You Discover What They Are. Contact a professional today.

A fulfilling retirement starts with confidence in your plan. Keep in mind that. All you need to begin is your current Roth IRA.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. TraditionalSIMPLESEP IRA Before Tax Traditional SIMPLE or SEP IRA After Tax Roth IRA After Tax Regular Taxable Savings After Tax Age. Find a Dedicated Financial Advisor Now.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Use our IRA calculators to get the IRA numbers you need. Titans calculator uses the historical average growth rates for US.

Ad Open an IRA Explore Roth vs. Roth IRA Estimate Calculator. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021.

This rate is not adjusted for inflation. The amount you will contribute to your Roth IRA each year. Traditional or Rollover Your 401k Today.

This limit applies across all IRAs. It is important to. While long-term savings in a Roth IRA may.

Refine Your Retirement Strategy with Innovative Tools and Calculators. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Estimate Roth Ira Growth A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the.

The Roth individual retirement account Roth IRA has a contribution limit which is 6000 in 2022or 7000 if you are age 50 or older. While long-term savings in a Roth IRA may. Do Your Investments Align with Your Goals.

A Roth IRA allows you to pay taxes now and withdraw funds tax-free at retirement. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Assuming youre not about to retire next year you want development and focused investments for your Roth IRA.

Make a Thoughtful Decision For Your Retirement. Ad Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. Calculate Roth IRA Growth.

Roth IRA Growth Example Heres an example. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Best Roth Ira Calculators

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Traditional Vs Roth Ira Calculator

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Custodial Roth Iras And The Magic Of Compound Interest

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro